Stay competitive and CBAM-compliant

Don’t risk losing business. Deliver CBAM-aligned emissions reporting to meet customer demands and gain clear visibility into how CBAM impacts your product costs.

Get started in minutes, not months

Choose your path: draw your factory diagram, upload existing data, or import official templates—we make onboarding quick and easy

Map your factory

Visually map your production processes with our intuitive diagramming tool

Calculate Embedded Emissions & Free Allocation

Automate emissions and free allocation calculations—or simply upload your completed CBAM/EFDA template

Prepare for Verification

Generate your operator’s emissions report, summary, and monitoring plan

Factory-Level Carbon Accounting

Comprehensive emissions tracking and automated CBAM calculations aligned with the EU CBAM methodology

Visual Process Mapping

Avoid complicated spreadsheets. Visually map your factory’s inputs, production processes, and outputs for complete emissions tracking.

Centralized Emission Factors

Access a centralised database containing calculation factors for electricity, fuels, and raw materials, CBAM benchmarks, and default values for precursors.

Automated Emissions and Free Allocation Calculations

Automate specific embedded emissions and free allocation calculations in full alignment with the CBAM methodology.

Actionable Emissions & Cost Analytics

Compare your products’ emissions against benchmarks—and track the financial impact of CBAM on your sales.

Benchmark Comparisons

Compare your products’ emissions against country-specific benchmarks to understand your carbon performance

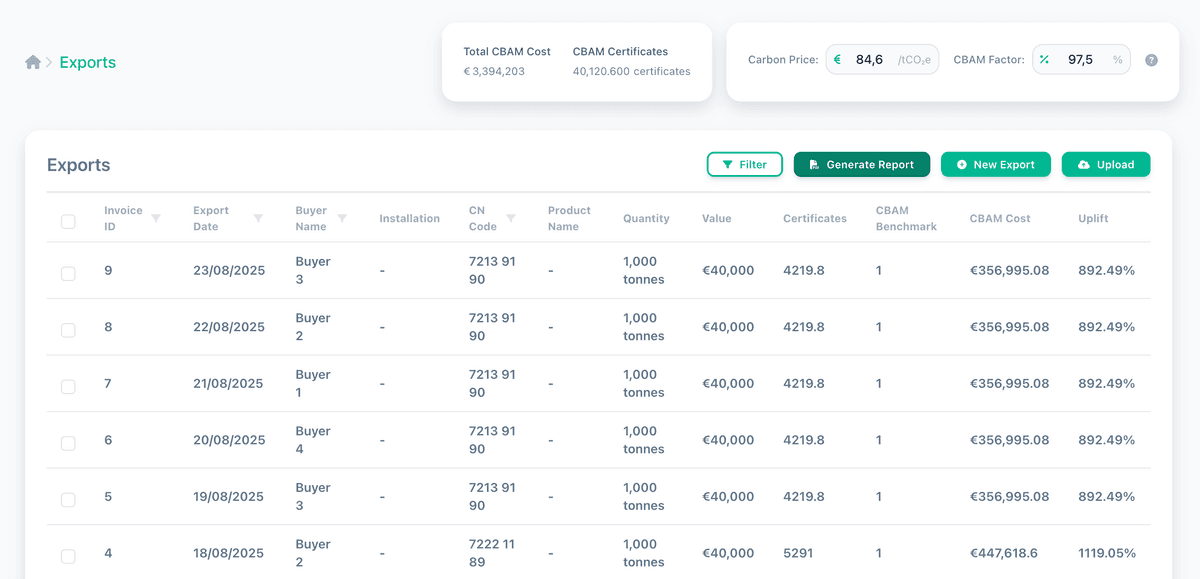

CBAM Costs Tracking

Instantly see the CBAM premium per product and the CBAM charge for every export—understand how it impacts your customers' costs and your competitiveness

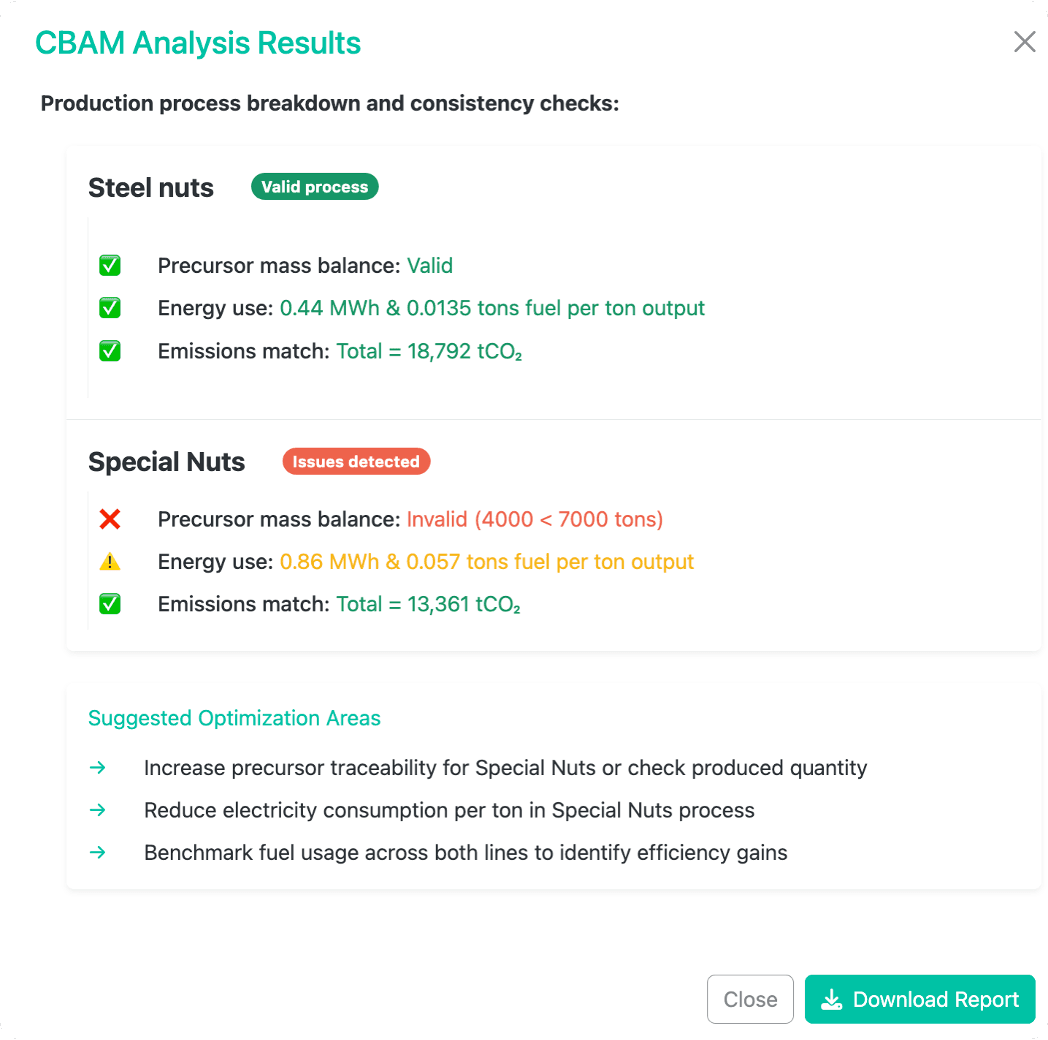

Emissions Hotspot Identification

Identify emissions hotspots and compare carbon costs across suppliers and products to identify cost-saving opportunities

Get Ready For Verification

Centralize your CBAM data and prepare the documentation needed for verification.

Centralised Data Repository

Keep all CBAM-related data centralized in one secure location for easy audit and management.

Verification Documentation

Secure the required documentation for verification: your operator’s emissions report, a summary thereof, a declarant-specific addendum (if applicable), and your monitoring plan.

Address any verification issues

Correct misstatements, non-conformities or non-compliance issues found and requested by the verifier.

Are your products covered by the EU CBAM?

Check it out now with our CN code checker

Frequently Asked Questions

Get answers to common questions about CBAM compliance for manufacturers

What industries are covered by the EU CBAM?

CBAM currently covers cement, iron and steel, aluminium, fertilizers, electricity, and hydrogen. Its scope is limited to basic materials and semi-finished products, although some finished goods are also included.

What are manufacturers' obligations during the CBAM transitional phase (2023-2025)?

Third-country manufacturers have no direct legal obligations under the CBAM Regulation. However, if they choose to share actual embedded emissions data with EU customers during the definitive phase, this data must be verified by an accredited third-party verifier to be usable.

What are manufacturers' obligations during the CBAM definitive phase? (From 2026)

During the CBAM definitive phase, manufacturers must verify the emissions data they share with EU importers.

Is there a de minimis threshold for manufacturers?

No, there is no de minimis threshold for manufacturers. If you supply CBAM-covered goods to EU importers falling under the CBAM scope, or to other manufacturers who export to the EU, you should be prepared to provide the necessary emissions data, regardless of the quantity.

Are there penalties for manufacturers who do not provide emissions data?

While manufacturers are not directly subject to legal penalties under CBAM, failure to provide accurate emissions data can have commercial consequences. EU importers may opt to use default emission values, which are typically higher than actual emissions, potentially making your products less competitive in the EU market.

Do manufacturers have to pay for the embedded emissions of their products?

No, the financial responsibility for embedded emissions lies with EU importers, who will be required to purchase CBAM certificates starting in 2026. However, manufacturers should be aware that higher reported emissions can increase CBAM costs for importers, potentially affecting the competitiveness of their products.

Can carbon prices paid in the country of origin be deducted?

Yes. If a carbon price has been paid in the country of origin for the embedded emissions of the imported goods, this cost can be fully deducted from the CBAM obligation. You will need to provide importers with evidence of such payments.

Can manufacturers of complex goods use default values for precursor goods?

Yes, emissions for complex goods can be calculated using default values for one or more precursors of the complex goods.

Protect your margins and win more business

Get complete CBAM visibility to understand cost impacts, optimize pricing, and outcompete rivals