The EU Carbon Border Adjustment Mechanism (CBAM)

Data Requirements for EU Importers

The EU CBAM began on the first of October 2023 with a transitional period. During this period, EU reporting declarants, who can be either the EU importer or an indirect customs representative, are required to submit quarterly CBAM reports to the EU Commission.

These reports must include information about the total quantity of imported CBAM goods over the preceding quarter, the direct and indirect embedded emissions in those goods, as well as information about any carbon prices due in the countries of origin for those embedded emissions. Click on the button below to navigate to our dedicated page for EU Importers.

Data Requirements for Third-country Operators

Third-country operators need to monitor the direct and indirect emissions of the installations where they produce the CBAM goods. EU reporting declarants will eventually rely on this actual data to fulfill their reporting obligations.

Emissions must be measured following the EU monitoring methodology. Until December 31, 2024, third-country operators can use alternative monitoring and reporting methods already in place at their installations, provided these methods achieve similar coverage and accuracy in emissions data compared to the EU method.

What has happened so far?

Deadline to submit the 2nd CBAM Report

The second quarterly CBAM report was due by the end of April 2024.

Deadline to submit the 1st CBAM Report

The first quarterly CBAM report was due by the end of January 2024. Due to technical issues encountered in the EU CBAM portal, the EU Commission provided an extended deadline for affected declarants. This extension will allow them to submit the first CBAM report by the end of February 2024.

A delayed submission can also be requested by declarants who have been requested by the National Competent Authority (NCA) to submit a CBAM report. The Commission has published a Guidance for declarants to request delayed submissions.

Start of the EU CBAM Transitional Period

The EU Carbon Border Adjustment Mechanism (CBAM) transitional period began on October 1, 2023. During this period there will be no financial obligations for importers but only reporting obligations.

Publication of the EU CBAM Implementing Regulation

The EU CBAM Implementing Regulation containing the detailed set of rules for the transitional period was published in the Official Journal of the European Union (OJEU) on August 17, 2023.

Publication of the EU CBAM Regulation

The EU CBAM Regulation was published in the Official Journal of the European Union (OJEU) on May 16, 2023 and entered into force the following day.

EU CBAM Goods

Cement

Iron and Steel

Aluminium

Fertilizers

Chemicals

Electricity

Calcined Clay

2507 00 80 – Other kaolinic clays

Cement clinker

2523 10 00 – Cement clinkers

Cement

2523 21 00 – White Portland cement, whether or not artificially coloured

2523 29 00 – Other Portland cement

2523 90 00 – Other hydraulic cements

Aluminous Cement

2523 30 00 – Aluminous cement

Unwrought aluminium

7601 – Unwrought Aluminium

Aluminium products

7603 – Aluminium powders and flakes

7604 – Aluminium bars, rods and profiles

7605 – Aluminium wire

7606 – Aluminium plates, sheets and strip, of a thickness exceeding 0,2 mm

7607 – Aluminium foil (whether or not printed or backed with paper, paper-board, plastics or similar backing materials) of a thickness (excluding any backing) not exceeding 0,2 mm

7608 – Aluminium tubes and pipes

7609 00 00 – Aluminium tube or pipe fittings (for example, couplings, elbows, sleeves)

7610 – Aluminium structures (excluding prefabricated buildings of heading 9406) and parts of structures (for example, bridges and bridge-sections, towers, lattice masts, roofs, roofing frameworks, doors and windows and their frames and thresholds for doors, balustrades, pillars and columns); aluminium plates, rods, profiles, tubes and the like, prepared for use in structures

7611 00 00 – Aluminium reservoirs, tanks, vats and similar containers, for any material (other than compressed or liquefied gas), of a capacity exceeding 300 litres, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment

7612 – Aluminium casks, drums, cans, boxes and similar containers (including rigid or collapsible tubular containers), for any material (other than compressed or liquefied gas), of a capacity not exceeding 300 litres, whether or not lined or heat- insulated, but not fitted with mechanical or thermal equipment

7613 00 00 – Aluminium containers for compressed or liquefied gas

7614 – Stranded wire, cables, plaited bands and the like, of aluminium, not electrically insulated

7616 – Other articles of aluminium

Sintered Ore

2601 12 00 – Agglomerated iron ores and concentrates, other than roasted iron pyrites

Pig Iron

7201 – Pig iron and spiegeleisen in pigs, blocks, or other primary forms – Some products under 7205 (Granules and powders, of pig iron, spiegeleisen, iron, or steel) may be covered here

Some products under 7205 (Granules and powders, of pig iron, spiegeleisen, iron, or steel) may be covered here

Ferro-alloy: FeMn

7202 1 – Ferro-manganese

Ferro-alloy: FeCr

7202 4 – Ferro-chromium

Ferro-alloy: FeNi

7202 6 – Ferro-nickel

DRI

7203 – Ferrous products obtained by direct reduction of iron ore and other spongy ferrous products

Crude Steel

7206 – Iron and non-alloy steel in ingots or other primary forms (excluding iron of heading 7203)

7207 – Semi-finished products of iron or non-alloy steel

7218 – Stainless steel in ingots or other primary forms; semi- finished products of stainless steel

7224 – Other alloy steel in ingots or other primary forms; semi- finished products of other alloy steel

Iron or steel products

7205 – Granules and powders, of pig iron, spiegeleisen, iron or steel (if not covered under category pig iron)

7208 – Flat-rolled products of iron or non-alloy steel, of a width of 600 mm or more, hot-rolled, not clad, plated or coated

7209 – Flat-rolled products of iron or non-alloy steel, of a width of 600 mm or more, cold-rolled (cold-reduced), not clad, plated or coated

7210 – Flat-rolled products of iron or non-alloy steel, of a width of 600 mm or more, clad, plated or coated

7211 – Flat-rolled products of iron or non-alloy steel, of a width of less than 600 mm, not clad, plated or coated

7212 – Flat-rolled products of iron or non-alloy steel, of a width of less than 600 mm, clad, plated or coated

7213 – Bars and rods, hot-rolled, in irregularly wound coils, of iron or non-alloy steel

7214 – Other bars and rods of iron or non-alloy steel, not further worked than forged, hot-rolled, hot-drawn or hot-extruded, but including those twisted after rolling

7215 – Other bars and rods of iron or non-alloy steel

7216 – Angles, shapes and sections of iron or non-alloy steel

7217 – Wire of iron or non-alloy steel

7219 – Flat-rolled products of stainless steel, of a width of 600 mm or more

7220 – Flat-rolled products of stainless steel, of a width of less than 600 mm

7221 – Bars and rods, hot-rolled, in irregularly wound coils, of stainless steel

7222 – Other bars and rods of stainless steel; angles, shapes and sections of stainless steel

7223 – Wire of stainless steel

7225 – Flat-rolled products of other alloy steel, of a width of 600 mm or more

7226 – Flat-rolled products of other alloy steel, of a width of less than 600 mm

7227 – Bars and rods, hot-rolled, in irregularly wound coils, of other alloy steel

7228 – Other bars and rods of other alloy steel; angles, shapes and sections, of other alloy steel; hollow drill bars and rods, of alloy or non-alloy steel

7229 – Wire of other alloy steel

7301 – Sheet piling of iron or steel, whether or not drilled, punched or made from assembled elements; welded angles, shapes and sections, of iron or steel

7302 – Railway or tramway track construction material of iron or steel, the following: rails, check-rails and rack rails, switch blades, crossing frogs, point rods and other crossing pieces, sleepers (cross-ties), fish- plates, chairs, chair wedges, sole plates (base plates), rail clips, bedplates, ties and other material specialised for jointing or fixing rails

7303 – Tubes, pipes and hollow profiles, of cast iron

7304 – Tubes, pipes and hollow profiles, seamless, of iron (other than cast iron) or steel

7305 – Other tubes and pipes (for example, welded, riveted or similarly closed), having circular cross-sections, the external diameter of which exceeds 406,4 mm, of iron or steel

7306 – Other tubes, pipes and hollow profiles (for example, open seam or welded, riveted or similarly closed), of iron or steel

7307 – Tube or pipe fittings (for example, couplings, elbows, sleeves), of iron or steel

7308 – Structures (excluding prefabricated buildings of heading 9406) and parts of structures (for example, bridges and bridge- sections, lock- gates, towers, lattice masts, roofs, roofing frameworks, doors and windows and their frames and thresholds for doors, shutters, balustrades, pillars and columns), of iron or steel; plates, rods, angles, shapes, sections, tubes and the like, prepared for use in structures, of iron or steel

7309 – Reservoirs, tanks, vats and similar containers for any material (other than compressed or liquefied gas), of iron or steel, of a capacity exceeding 300 l, whether or not lined or heat- insulated, but not fitted with mechanical or thermal equipment

7310 – Tanks, casks, drums, cans, boxes and similar containers, for any material (other than compressed or liquefied gas), of iron or steel, of a capacity not exceeding 300 l, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment

7311 – Containers for compressed or liquefied gas, of iron or steel

7318 – Screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers (including spring washers) and similar articles, of iron or steel

7326 – Other articles of iron or steel

Nitric acid

2808 00 00 – Nitric acid; sulphonitric acids

Urea

3102 10 – Urea, whether or not in aqueous solution

Ammonia

2814 – Ammonia, anhydrous or in aqueous solution

Mixed fertilizers

2834 21 00 – Nitrates of potassium

3102 – Mineral or chemical fertilisers, nitrogenous except 3102 10 (Urea)

3105 – Mineral or chemical fertilisers containing two or three of the fertilising elements nitrogen, phosphorus, and potassium; other fertilisers – Except: 3105 60 00 – Mineral or chemical fertilisers containing the two fertilising elements phosphorus and potassium

Hydrogen

2804 10 00 – Hydrogen

Electricity

2716 00 00 – Electrical energy

Where fewer than 8 digits appear, it means that all CN codes starting with those digits are covered.

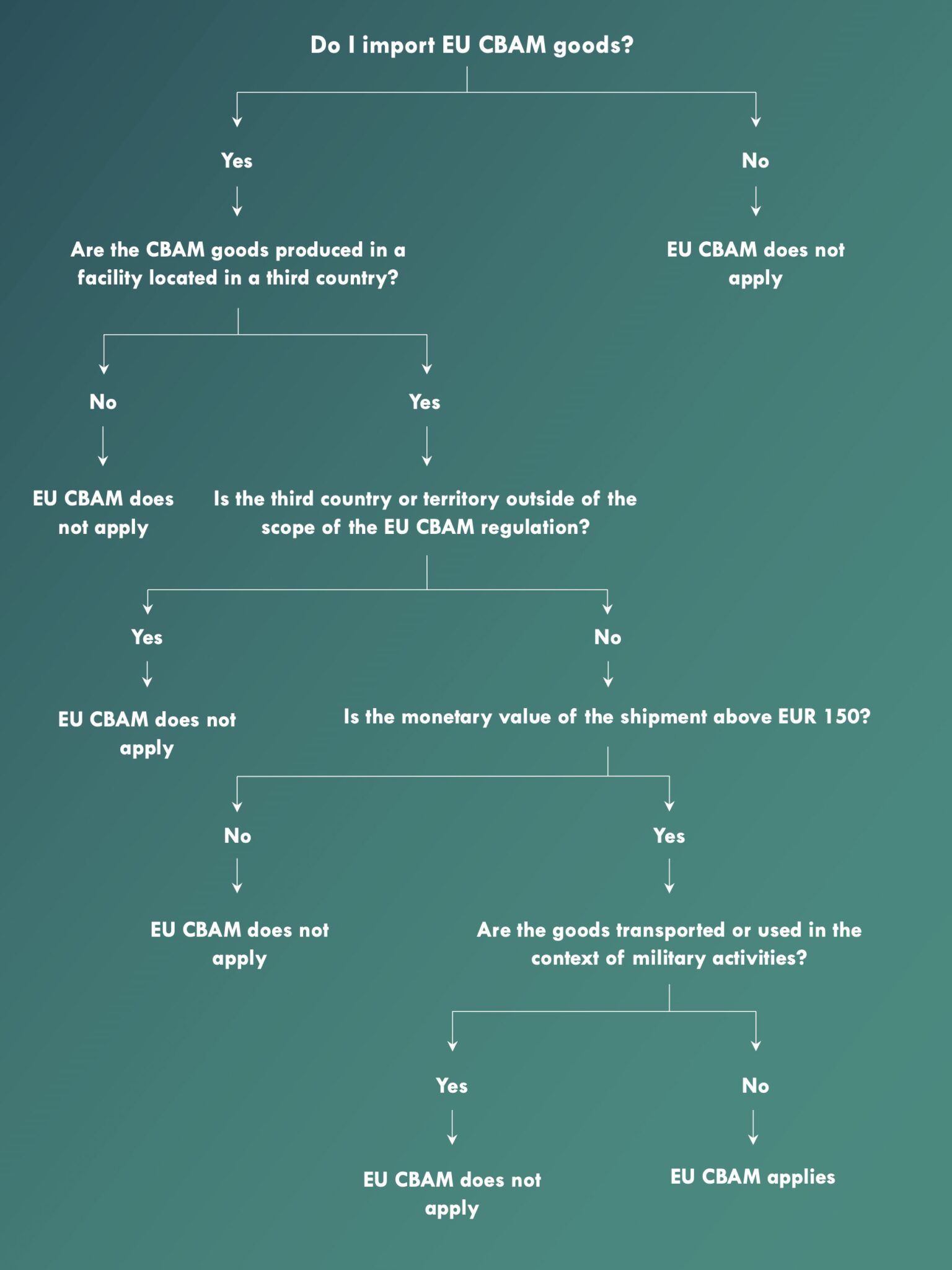

EU CBAM Exemptions

The EU CBAM applies to goods originating in a third country. However, it does not apply to goods coming from:

- Iceland*

- Liechtenstein*

- Norway*

- Switzerland**

- Büsingen

- Heligoland

- Livigno

- Ceuta

- Melilla

* EU ETS applies

** Fully linked to the EU ETS

Small quantities (de minimis) of imported CBAM goods may be exempted. In particular, CBAM goods imported into the EU that do not exceed EUR 150 per shipment are exempt from EU CBAM obligations.

CBAM goods that are imported for use or movement within the context of military activities are excluded from the scope of the EU CBAM.

The EU CBAM includes the importation of electricity from third countries within its scope. However, there's an exception outlined in Article 2.7 of the CBAM Regulation. It states that if a third country or territory is closely integrated with the Union's internal electricity market and no technical solution for applying the CBAM can be found, then the CBAM won't apply. This exemption is only valid if certain conditions are fulfilled, which are detailed in Article 2.7 of the CBAM Regulation.

Self Assessment

If you or your clients are affected by the EU CBAM

What's next?

Deadline for the 3rd CBAM Report

Must include data for Q2 2024

Must include data for Q3 2024

Must include data for Q4 2024

Must include data for Q1 2025

Deadline for modifying the 6th CBAM Report

Must include data for Q2 2025

Must include data for Q3 2025

Must include data for Q4 2025